China is currently the second-largest market globally for sports brands and is anticipated to soon become the leading market for sportswear and equipment worldwide. With a compound annual growth rate (CAGR) of 9%, China’s market growth significantly surpasses that of the United States, which has a CAGR of 2.5%.

Despite this impressive growth trajectory, sports participation in China remains lower than in more established Western markets. For instance, only 6% of Chinese individuals engage in jogging or running, compared to 25% in Germany. To address this, the Chinese government has invested US$1.9 billion in sports facilities and continues to promote physical education in schools while reducing student workloads outside of school. These efforts suggest that the market’s potential is far from fully realized.

In recent years, local Chinese sportswear brands such as Anta and Li-Ning have captured a significant share of the market. However, foreign brands still maintain the majority market share.

Source: https://www.statista.com/statistics/432292/leading-sportswear-brands-in-china/

E-Commerce & Social Commerce are King in China

For the aforementioned brands, online platforms represent the primary sales channel. Nowhere else in the world is e-commerce as crucial as it is in China. Over half of all goods and services in China are sold online, compared to just 11% in Germany, making China the world’s leading e-commerce market by a significant margin. Globally, one in every four products sold online is purchased in China.

Additionally, social commerce is a standard practice in China, with direct sales through social media generating trillions of Dollars. In the first ten months of 2023 alone, Douyin facilitated over US$274 billion in social commerce sales, surpassing the entire annual GDP of Berlin. As platforms like Tmall increasingly integrate social features and as commercial functions and livestreaming on social media continue to grow, the distinction between social and e-commerce in China is becoming progressively indistinct.

DACH Sports Brands in China

As a global digital agency with German roots, we take pride in the worldwide success of sports brands originating from German-speaking markets. Our focus has been on analyzing the performance of these brands in China, selecting some of the most pertinent ones for our study.

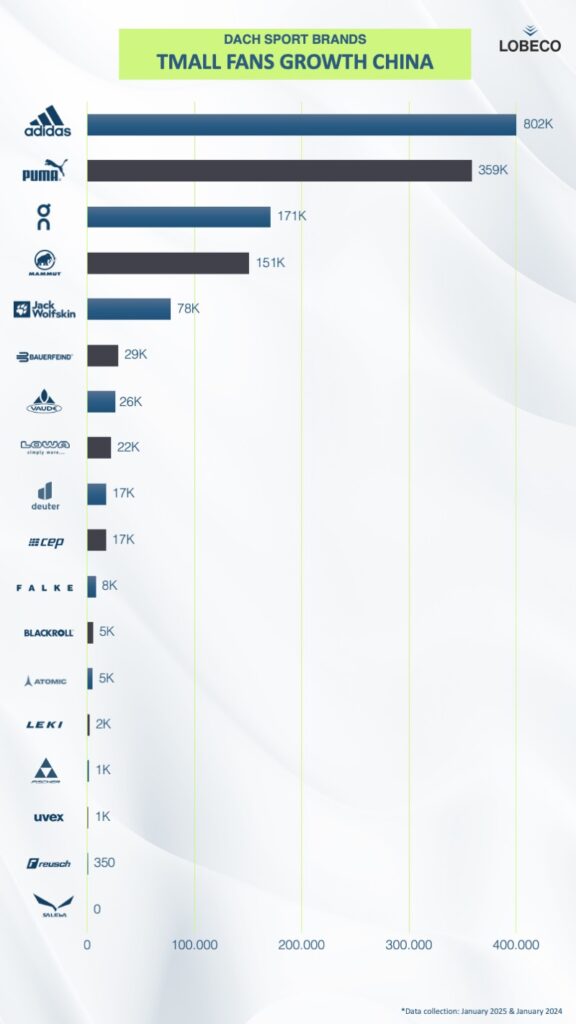

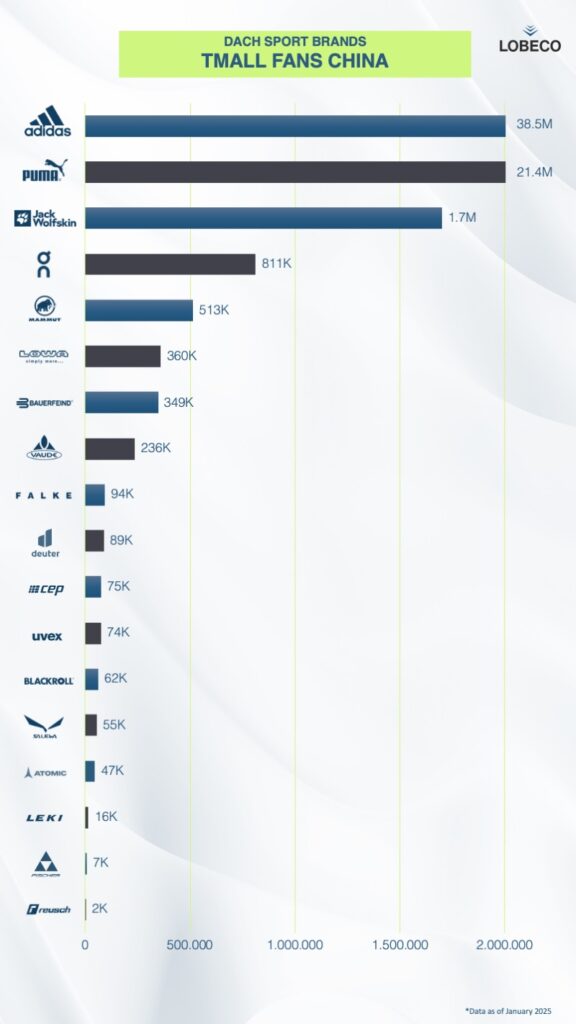

To evaluate their commercial success, we began by examining the number of “Fans” on their official Tmall channels. This metric offers valuable insights into their performance and market presence in China.

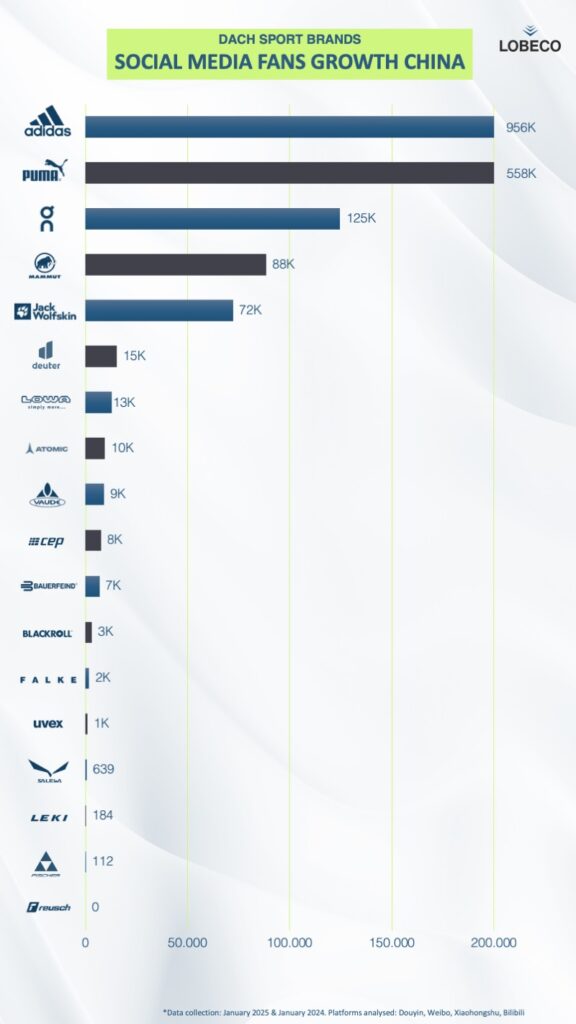

After, we looked at the social media presence of the respective brands.

We then assessed the relationship between social media presence and online commercial performance in China, discovering a strong positive linear correlation of 0.93. This indicates that a robust social media presence is a crucial factor for the commercial success of sports brands in China. While fans and followers alone do not provide a complete picture in either social media or e-commerce, they serve as a valuable indicator.

Given the closely linked nature of social media and e-commerce in China, this correlation is unsurprising. Social media platforms are integral to the entire marketing funnel, from brand awareness to conversion and after-sales service. This is particularly important for mid-sized brands that need to establish themselves in the market.

Learning from Best Cases

So how can medium sized brands establish themselves in China? We identified three best cases to describe it as concrete as possible.

ON

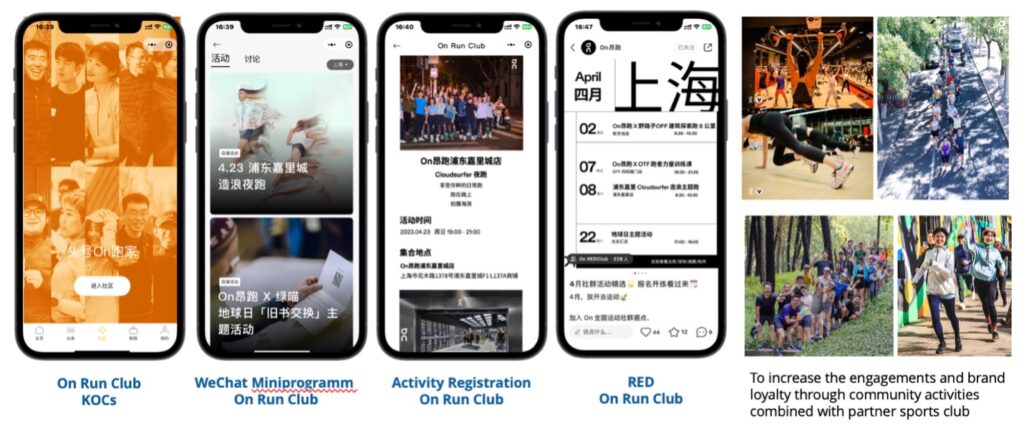

The Swiss brand has excelled in centering its marketing activities around its community, more effectively than many others. By regularly hosting offline events throughout China, the company successfully extends its community engagement to the online realm. Within its WeChat Mini Program—a lightweight app within WeChat’s ecosystem—customers can access several features:

Content from On’s Key Opinion Leaders (KOLs) that offers guidance to other customers.

The “On Run Club” Community Center, which includes user-generated content (UGC). An event registration hub.

Additionally, the “On Run Club” is also present on Xiaohongshu, often referred to as China’s Pinterest or Instagram. On both platforms, a shop is directly integrated to effectively monetize the target audience.

Bauerfeind

Bauerfeind, a German brand, has successfully established itself in the Chinese market. A key factor in its success is the strategic use of its global ambassador, Dirk Nowitzki. Basketball is arguably the most popular team sport in China, particularly among younger audiences. Nowitzki, a superstar in his own right, not only attracts significant attention to the brand but also provides an authentic connection, as both he and the product are well-suited for basketball players.

Additionally, Bauerfeind has built a strong social media presence on platforms like Douyin and WeChat by focusing on highly educational content. Given that the brand specializes in sports medical wearables and that Chinese sports consumers may not be as well-versed in this area, this approach is particularly effective.

DACH brands are Losing Out.

As one may have noticed, several well-known brands from the DACH region are currently not active in the Chinese market, while others have entered but are still facing challenges in gaining a foothold.

Despite the intense competition, various sportswear brands are demonstrating potential pathways to success, indicating that there remains significant room for growth. Achieving success in China can propel a brand and its entire company to new heights. However, this requires time, the right strategy and partners, as well as investment resources.